Do You Know Your Number?

To understand where you are today and where you are heading financially, you need to know your number. How much money will you need to retire and maintain your lifestyle? Can you retire early or will you have to keep working into your seventies? How much will it cost to send your children to university? What would happen to your mortgage costs or your savings and investments if interest rates changed dramatically in the coming years? How much life cover should you have? Are you saving enough or spending too much? Will you run out of money during your retirement years? Or perhaps you can afford that dream house or that world cruise after all?

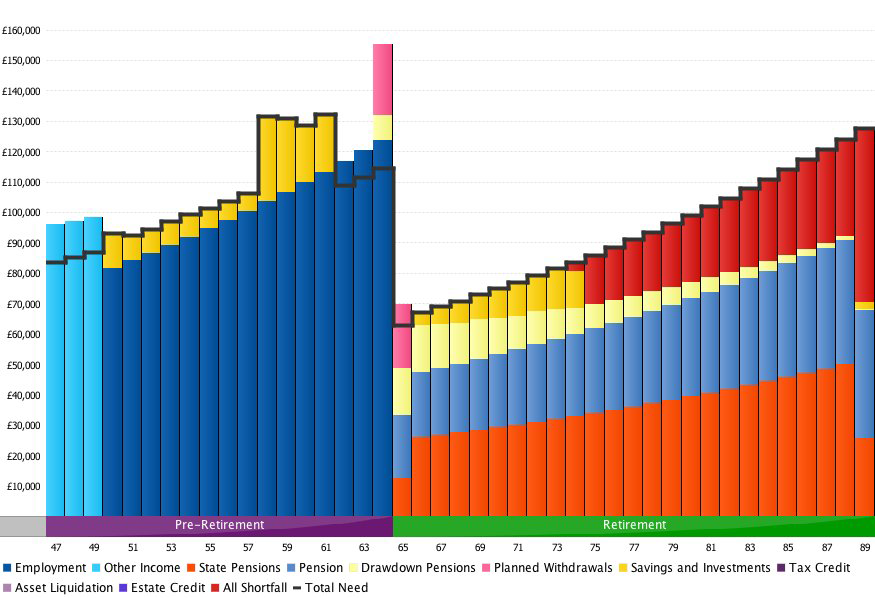

At Chartered Global we have invested in the most advanced cashflow modelling software available on the market today. Years ahead of what most advisers or banks offer their clients, our systems provide us with answers to your most important financial questions and is an essential part of our comprehensive financial planning process. By analysing your current and future income, savings, investments, assets, taxes, liabilities and expenditures, our sophisticated cashflow modelling can ensure that you make the best financial decisions today to assure a bright future tomorrow.

At Chartered Global we have invested in the most advanced cashflow modelling software available on the market today. Years ahead of what most advisers or banks offer their clients, our systems provide us with answers to your most important financial questions and is an essential part of our comprehensive financial planning process. By analysing your current and future income, savings, investments, assets, taxes, liabilities and expenditures, our sophisticated cashflow modelling can ensure that you make the best financial decisions today to assure a bright future tomorrow.

Don’t leave it too late to find the answers you need.

✔️ Provide a clear picture of your current and future financial position

✔️ Plan for future expenses and key long term goals

✔️ Identify potential risks and shortfalls

✔️ Clarify what actions need to be taken to reach your goals

✔️ Explore “what if” scenarios to ensure that you are financially prepared for life’s unexpected turns

✔️ Take control of the financial future for you and your family